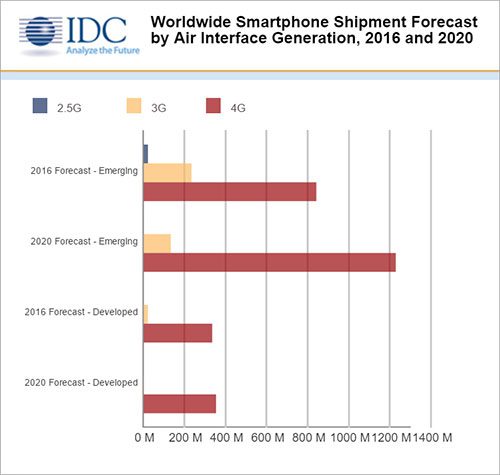

4G smartphone shipments will exceed 1 billion units in 2016, thanks in part to the rise affordable 4G connectivity options in emerging markets.

IDC’s latest forecast calls for shipments of 1.17 billion 4G smartphones, compared to 967 billion last year, a 21.3-percent increase. By 2020, the analyst firm expects 4G smarpthone shipments to reach nearly 1.6 billion units.

Melissa Chau, associate research director at IDC’s Worldwide Quarterly Mobile Device Trackers unit, noted that 4G struggled to gain traction “in many emerging markets as 4G data tariffs have long been very expensive compared to 3G, while 4G handsets themselves have also been relatively pricey across the board,” in a statement. “We are quickly seeing this change in key growth markets like India where new operator Reliance Jio is aggressively trying to shake up the market by handing out free 4G SIM cards and launching own-branded low-cost 4G-enabled smartphones.”

Last year, 4G-enabled smartphones accounted for 61 percent of all smartphone shipments in emerging markets. This year, that figure is expected to jump to 22 percent. Asia-Pacific (excluding Japan), Latin America, Central and Eastern Europe, and the Middle East and Africa, all fall into the emerging markets category.

In contrast, 85 percent of all smartphones shipped to mature markets (U.S., Canada, Japan and Western Europe) were 4G-enabled. This year, IDC expects that 94 percent will support 4G speeds.

Google is making a big push this holiday shopping season with new hardware, said IDC program vice president Ryan Reith.

“In North America and Western Europe, Google has been putting a significant amount of marketing dollars behind the new Pixel and Pixel XL, although early supply chain indications are that volumes are not at the point where Samsung or Apple should see a significant impact for Q4,” said Reith in prepared remarks. “Of course, as we head into 2017 this can change, but many eyes will be on Google to see how serious they are about pursuing the hardware play.”

Apple, meanwhile, is expected to close out 2016 as the first full year of declining iPhone shipments, despite a warm reception for the iPhone 7 and 7 Plus. IDC expects Apple to “have something big up its sleeve” next year to mark the iconic handset’s tenth anniversary. Until then, the company is facing competition from low-cost vendors and Google on the high end.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Ethics and Artificial Intelligence: Driving Greater Equality

FEATURE | By James Maguire,

December 16, 2020

AI vs. Machine Learning vs. Deep Learning

FEATURE | By Cynthia Harvey,

December 11, 2020

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2021

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.