Public cloud giants slowed their spending in the first quarter (Q1) of 2016, but that didn’t stop the cloud hardware market from making some gains.

Worldwide, cloud IT infrastructure vendors sold $6.6 billion worth of servers, storage and Ethernet switch networking equipment, a 3.9 percent year-over-year increase, said research firm International Data Corporation (IDC). Public clouds were responsible for $3.9 billion of that total.

Protecting your company’s data is critical. Cloud storage with automated backup is scalable, flexible and provides peace of mind. Cobalt Iron’s enterprise-grade backup and recovery solution is known for its hands-free automation and reliability, at a lower cost. Cloud backup that just works.

“A slowdown in hyperscale public cloud infrastructure deployment demand negatively impacted growth in both public cloud and cloud IT overall,” observed IDC research director Kuba Stolarski, in a statement. “Private cloud deployment growth also slowed, as 2016 began with difficult comparisons to 1Q15, when server and storage refresh drove a high level of spend and high growth. As the system refresh has mostly ended, this will continue to push private cloud and, more generally, enterprise IT growth downwards in the near term.

Server and Ethernet switch sales to public clouds jumped 8.7 percent and 69.4 percent respectively, while storage dropped 29.6 percent from a year ago. On the private cloud side of the market, server revenues fell 1.1 percent but both storage and switches experienced gains of 11.5 percent and 53.7 percent, respectively.

All told, the cloud IT infrastructure market accounted for nearly a third (32.3 percent) of all IT revenues during Q1, an increase of over 2 percent compared to last year.

Regionally, sales grew briskly in the Middle East and Africa (25.9 percent), Western Europe (20.6), Asia-Pacific (18.5) and Japan (17.7 percent). Latin America experienced the biggest decline (21.2 percent) while revenues in the U.S. slipped 4.1 percent. Sales in Central and Eastern Europe were essentially flat (-0.1 percent). Meanwhile, Canadian sales jumped 9.5 percent.

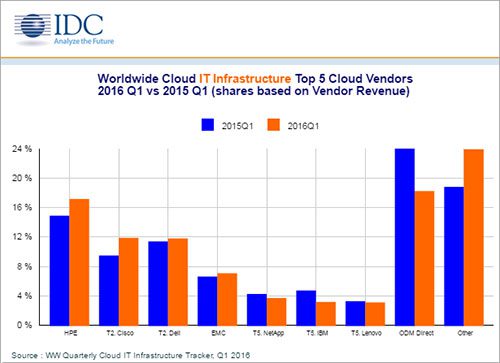

HP Enterprise (HPE) won first place with revenues of approximately $1.14 billion and a 17.2 percent share of the market. Cisco and Dell tied for second place with over $780 million and nearly 12 percent of the market apiece. Rounding out the top five are EMC, with NetApp, IBM and Lenovo tied for fifth place.

Over time, IDC expects hyperscale cloud operators like Amazon, Microsoft and IBM to help reinvigorate the market as they work to expand their global data center footprints. “Hyperscale demand should return to higher deployment levels later this year, bolstered by service providers who have announced new datacenter builds expected to go online this year,” said Stolarski.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Ethics and Artificial Intelligence: Driving Greater Equality

FEATURE | By James Maguire,

December 16, 2020

AI vs. Machine Learning vs. Deep Learning

FEATURE | By Cynthia Harvey,

December 11, 2020

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2021

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.