Over the next several years, blockchain could soon turn into big bucks for software vendors that can capitalize on the technology, according to a forecast from Tractica.

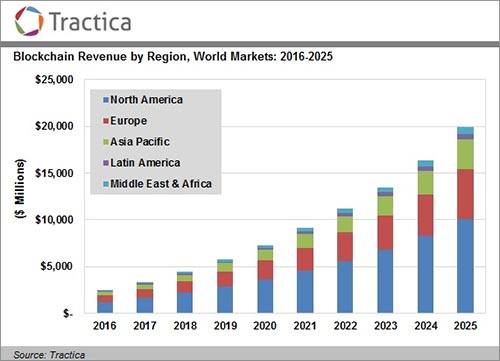

The market research firm expects the worldwide market for enterprise blockchain applications to reach $19.9 billion by 2015 from $2.5 billion this year. North America will primarily drive demand during the forecast period, followed by Europe.

Best known for its Bitcoin implementation, the distributed ledger technology is highly resistant to tampering and can potentially streamline many of today’s complex financial, trading and recordkeeping platforms by eliminating intermediaries.

But, it may take a while for the technology to hit the mainstream, cautioned Tractica principal analyst, Jessica Groopman.

She observed that “while the blockchain market has generated massive interest and investment from just about every type of institution, the reality today is that enterprise blockchain applications are extremely nascent with very few deployments in production outside of Bitcoin,” she observed in a blog post. “Whether deciding to jump on the bandwagon, or write it off as hype, businesses are well advised to first understand what blockchain is (and is not), as well as how blockchain technologies could support their core objectives and long-term strategies.”

This past summer, Gartner vice president David Furlonger advised technology executives to keep an eye on blockchain, but not go overboard. Although the technology is progressing rapidly, standards are a bit of a moving target, a risky state of affairs for businesses that make early bets on the future of blockchain in the enterprise.

Regardless, it can’t hurt to dip one’s toes into the waters, Furlonger added. High-tech companies may learn a thing or two by conducting a small-scale trial, provided they are prepared for failure at this early stage.

Meanwhile, blockchain has attracted intense interest from the investment community and some major corporations. Venture capitalists have poured more than $1 billion into blockchain startups, Tractica noted.

In October, IBM announced that the company was investing $200 million in its Watson IoT Center located in Munich, Germany, where the company plans to connect the AI-infused platform to blockchain, enabling businesses to securely share Internet of Things (IoT) data securely and efficiently.

Credit card giant Visa also recently announced that it was teaming with Chain, a San Francisco-based blockchain startup, to create a system for secure international business-to-business payments. A pilot of the platform, dubbed Visa B2B Connect, is scheduled for 2017.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Ethics and Artificial Intelligence: Driving Greater Equality

FEATURE | By James Maguire,

December 16, 2020

AI vs. Machine Learning vs. Deep Learning

FEATURE | By Cynthia Harvey,

December 11, 2020

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2021

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.