A growing number of businesses are bulking up their big data capabilities finds two new studies from technology research firms Gartner and IDC.

In its survey of 199 IT and business leaders, Gartner found that nearly half (48 percent) had invested in big data technology this year, a 3 percent gain compared to last year. Yet in the next two years, twenty-five percent said they plan to invest in big data this year, a considerable drop from 31 percent in 2015.

Nick Heudecker, research director at Gartner, noted that while big data spending is up, the analyst group’s findings are “showing signs of slowing growth with fewer companies having a future intent to invest,” in a statement. “The big issue is not so much big data itself, but rather how it is used. While organizations have understood that big data is not just about a specific technology, they need to avoid thinking about big data as a separate effort.”

Gartner also observed that enterprises are generally struggling to get big data projects into production.

Nearly three quarters of those polled by the firm said they had invested or planned to invest in big data, but few have ventured past the pilot stage. Just 15 percent have deployed big data project into production. “One explanation for this is that big data projects appear to be receiving less spending priority than competing IT initiatives,” Heudecker added.

Over at IDC, a new forecast points to major gains in the market for big data and business analytics solutions.

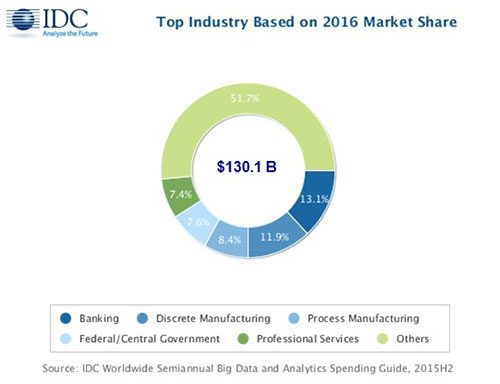

The firm’s analysts expect the market to grow to $203 billion in 2020, up from $130.1 billion this year. ” “This market is forecast to grow 11.3 percent in 2016 after revenues reached $122 billion worldwide in 2015 and is expected to continue at a compound annual growth rate (CAGR) of 11.7 percent through 2020,” said Dan Vesset, group vice president of IDC’s Analytics and Information Management practice, in prepared remarks.

Banks are spending the most on big data and business analytics solutions, to the tune of nearly $17 billion this year, according to IDC. Manufacturers manufacturing, government agencies and professional services companies are also among this year’s big spenders.

Naturally, large enterprises (500 employees and up) are leading the charge. They are expected to generate the majority of big data and business analytics revenues ($154 billion) in 2020. But the world’s small and midsized businesses are also getting in on the act, generating nearly a quarter of all revenues.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Ethics and Artificial Intelligence: Driving Greater Equality

FEATURE | By James Maguire,

December 16, 2020

AI vs. Machine Learning vs. Deep Learning

FEATURE | By Cynthia Harvey,

December 11, 2020

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2021

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.