New research from QuinStreet Enterprise reveals some surprising winners in the market for next-generation data center technologies.

Consider IT vendors, for example. Amazon, IBM and Dell top the list of vendors being evaluated by enterprises for next-generation data center solutions, with about one in five respondents looking at them in early stage evaluation (see graphic below).

Yet when it comes time to ask for RFPs, NetApp tops the list, with 12% of respondents saying they plan to ask NetApp for an RFP, just ahead of IBM, Amazon, VMware, Juniper, HP, Cisco and Oracle. Large established vendors seem to fare best for SDN and converged infrastructure deployments, according to the report, 2014 Data Center Outlook: Data Center Transformation — Where Is Your Enterprise?

Despite the tepid IT spending environment, the survey found that 88% of enterprises are investing in their data centers. What factors are prompting them to invest? Security, uptime and availability top the list of reasons, with greater efficiency, cost savings and business agility as less important considerations.

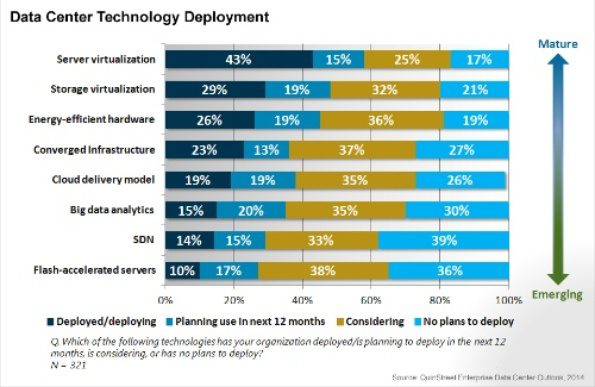

As for which technologies enterprises are spending money on now and in the near future, virtualization – both server and storage – is the most mature technology (see below). About 58% of respondents have deployed server virtualization or plan to in the next year. For storage virtualization, the number is 48%.

Energy-efficient hardware comes next at 45%, followed by a cloud delivery model at 38%, converged infrastructure, big data analytics at 35%, software-defined networking at 29%, and flash-accelerated servers at 27%.

The technologies that enterprises are considering deploying in the future – and therefore might have the most growth potential – are flash, converged infrastructure, energy-efficient hardware, big data analytics and cloud, with server virtualization lagging.

At the same time, nearly 40% of enterprises have no plans at all to deploy SDN and flash, so those technologies still face something of a battle for data center mind share.

When it comes time to select vendors for RFPs, customer service and ease of doing business trump other concerns, the survey found, with TCO concerns in third place and having a well-known brand considered the least important factor.

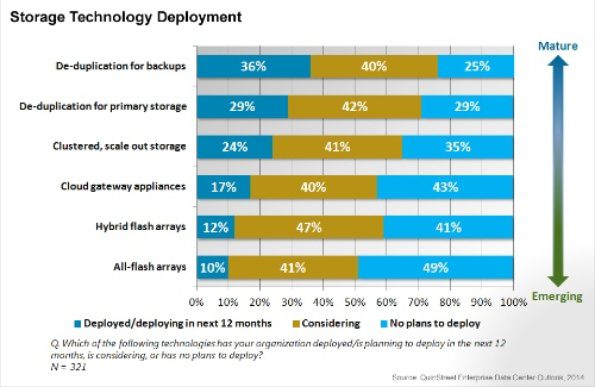

Storage technologies got quite a bit of attention in the survey, with deduplication the most mature technology, while scale-out storage, cloud gateways and flash still have significant market potential (see below).

And last but not least, when asked which information sources are most important, IT buyers placed tech content sites like the one you’re reading first, ahead of even peer networking and colleague recommendations.

The survey was conducted online by QuinStreet Enterprise Research using an email invitation sent to IT professionals and executives in the QuinStreet Enterprise database. All respondents were involved in the IT purchasing process for data center hardware, software and networking products. The survey was completed by 321 qualified professionals in July and August, with a margin of error of +/- 5.7%.

Paul Shread is editor in chief of QuinStreet Enterprise’s IT Business Edge Network.

Photo courtesy of Shutterstock.

Ethics and Artificial Intelligence: Driving Greater Equality

FEATURE | By James Maguire,

December 16, 2020

AI vs. Machine Learning vs. Deep Learning

FEATURE | By Cynthia Harvey,

December 11, 2020

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

FEATURE | By Samuel Greengard,

November 05, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

FEATURE | By Cynthia Harvey,

October 07, 2020

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

Top 10 Machine Learning Companies 2021

FEATURE | By Cynthia Harvey,

September 22, 2020

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

Datamation is the leading industry resource for B2B data professionals and technology buyers. Datamation's focus is on providing insight into the latest trends and innovation in AI, data security, big data, and more, along with in-depth product recommendations and comparisons. More than 1.7M users gain insight and guidance from Datamation every year.

Advertise with TechnologyAdvice on Datamation and our other data and technology-focused platforms.

Advertise with Us

Property of TechnologyAdvice.

© 2025 TechnologyAdvice. All Rights Reserved

Advertiser Disclosure: Some of the products that appear on this

site are from companies from which TechnologyAdvice receives

compensation. This compensation may impact how and where products

appear on this site including, for example, the order in which

they appear. TechnologyAdvice does not include all companies

or all types of products available in the marketplace.