Vendors shipped 62.4 million PCs during the second quarter (Q2) of 2016, a 4.5% year-over-year decline, according to International Data Corporation’s (IDC) latest Worldwide Quarterly PC Tracker report.

Despite the drop, the market actually beat earlier projections. IDC had originally forecast a 7.4 percent decline in PC shipments. The analyst group credits a rebound of sorts in the U.S. for the less than dire results.

“Our long-term outlook remains cautious. However, the strong results in the U.S. offer a glimpse of what the market could look like with pockets of growth and a stronger overall environment,” remarked Loren Loverde, vice president of Worldwide PC Trackers and Forecasting at IDC. “It’s not dramatic growth, but it could push the market into positive territory slightly ahead of our forecast for 2018.”

Chromebooks performed strongly in the education market, noted IDC research director Linn Huang. On the Windows front, PC makers are holding their breath, waiting to see if their commercial customers finally jump on Microsoft’s latest desktop OS. “The larger story remains whether an early wave of enterprise transition to Windows 10 could help close out a 2016 that is increasingly looking stronger in the U.S,” stated Huang.

In the U.S., PC shipments rose nearly 5 percent. HP and Dell battled it out for the top spot while Lenovo and Acer made solid gains, said IDC.

HP edged out Dell, shipping 4.7 million PCs compared to the 4.4 million PCs its rival managed to get out the door. Lenovo experienced a 14.7 percent year-over-year surge in PC shipments (2.4 million units) while Acer shipped 16 percent more units (889,000 PCs) than the same year-ago period.

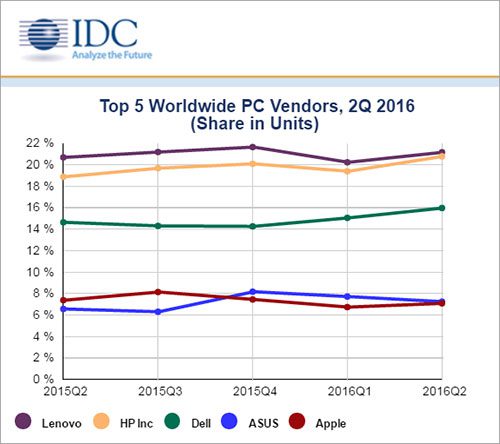

Worldwide, Lenovo was the vendor to beat with 13.2 million units and a 21.2-percent share of the market. HP was a close second with shipments of nearly 13 million shipped and 20.8 percent of the market, followed by Dell with 9.96 million PCs and 16 percent of the market. Asus and Apple round out the top five, each with shipments of over 4 million units and slightly more than 7 percent of the market.

Meanwhile, the industry is waiting to feel the repercussions of the Brexit vote in Europe. “Even the best case scenario calls for PCs to face significant challenges, with a somewhat fragile stabilization in the long run. The preliminary results did not capture the potential repercussions from the Brexit vote, which is expected to affect the timing and scope of spending plans in Europe,” stated IDC Worldwide PC Tracker research manager Jay Chou.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.