Datamation content and product recommendations are

editorially independent. We may make money when you click on links

to our partners.

Learn More

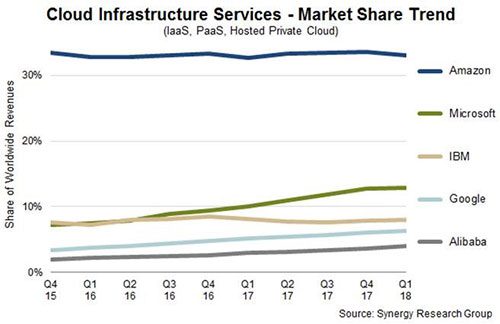

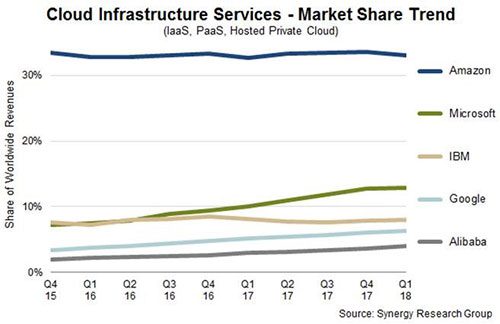

It appears that cloud market share numbers have fallen into a steady pattern here in 2018. To be sure, Cloud computing – and cloud computing companies – enjoy a booming demand, and here in 2018 this once nascent market keeps climbing skyward.

But the companies at the top are in a familiar holding pattern. The central battle: AWS vs. Azure vs. Google.

Cloud Storage and Backup Benefits

Protecting your company’s data is critical. Cloud storage with automated backup is scalable, flexible and provides peace of mind. Cobalt Iron’s enterprise-grade backup and recovery solution is known for its hands-free automation and reliability, at a lower cost. Cloud backup that just works.

SCHEDULE FREE CONSULT/DEMO

Synergy Research Group recently took stock of the cloud market share numbers for the first quarter (Q1) of 2018 and found that revenues had outpaced those of the same year-ago quarter by a significant margin. Cloud infrastructure describes services typically used by businesses to run IT workloads in the cloud, namely infrastructure as a service (IaaS), platform as a service (PaaS) and hosted private cloud.

“The growth rates were already impressive for such a large market, but you’d normally expect those growth rates to gradually diminish due to the law of large numbers and typical market development life cycles,” noted John Dinsdale, chief analyst and research director at Synergy Research Group. “In Q1-Q3 of last year the year-on-year growth rate was running at 45-43 percent; but it has now jumped up to 51 percent.”

In total, the market research firm estimated that sales are nearing $15 billion per quarter. And most of those spoils are going to just a handful of companies. In fact, among public cloud providers, the top five nabbed nearly three quarters of the market.

Cloud market share numbers reveal that AWS is clearly the market leader.

Amazon Takes the Cloud Market Share Crown

Simply put, Amazon Web Services (AWS) dominates with the largest cloud market share.

“As the cloud market continues to rapidly expand, AWS continues to control a third of the market, being larger than its next four competitors combined,” Dinsdale added. “It is particularly notable that growth at AWS has actually accelerated despite its scale.”

AWS alone commanded 33 percent of the market during the first quarter. Amazon generated over $5.4 billion in cloud sales during the period, a 49 percent over-over-year increase and proof that its early bet on the cloud is paying off.

Microsoft and Other Cloud Market Share Leaders

Microsoft Azure took second place, with 13 percent of the market, according to Synergy’s data.

Q1 was also a good quarter for the Redmond, Wash. technology giant, with a year-over-year increase in revenue of 16 percent for a grand total $26.8 billion. Satya Nadella, CEO of Microsoft, attributed much of that gain to increasing demand for its cloud solutions.

Although it took a while for Microsoft to jump on the cloud bandwagon—Amazon CEO Jeff Bezos boasted that his company had a seven-year head start—the company is hitting its stride and making up for lost time. The cloud has become such a money-maker for the company, which is historically known for its Windows operating system and other packaged software offerings, that it recently announced a reorganization effort with an emphasis on its cloud operations.

“The recent reorg at Microsoft reinforces its focus on Azure – and while it was slow to embrace cloud, Satya’s done a good job of bringing the overall sum of parts – biz apps, devices, cloud, and AI – together and making it compelling and relevant for cloud customers,” said Rebecca Wettemann, vice president of research at Nucleus Research.

Azure sales nearly doubled on an annual basis, noted Forrester vice president and principal analyst J. P. Gownder, and it shows no signs of slowing down.

“The 93-percent growth in Azure revenue shows that cloud continues to lead the way toward diversifying the sources of Microsoft’s revenue. Although Amazon remains the big leader with AWS, Azure is growing more quickly (albeit from a lower base),” Gownder noted. “As Microsoft continues to weave more AI offerings into its ‘intelligent cloud’ strategy, and offers a differentiated hybrid strategy with Azure Stack, the Azure business looks to continue fast growth.”

Rounding out the rest of the top five are IBM with eight percent of the market, followed by Google with six percent and Alibaba with four percent.

Cloud Market Share Trends

Businesses will continue to flock to cloud services over the next few years, making it a good time to be a public cloud provider.

Gartner recently forecast that sales of worldwide public cloud services will surpass $186 billion in 2018 compared to $153.5 billion last year. In 2021, that figure is expected to nearly double to a whopping $302.5 billion.

The cloud application or software as a service (SaaS) segment will take the lion’s share, generating revenue of over $117 billion in 2021. This spells good news for leading SaaS companies including Salesforce, Microsoft and Oracle, to name a few.

IaaS is another hotspot, raking in a projected $83.5 billion in 2021, followed by business process as a service (BPaaS) with $58.4 billion, PaaS ($27.3 billion) and cloud management and security ($16.1 billion).

-

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

-

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

-

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

-

Top 10 AIOps Companies

FEATURE | By Samuel Greengard,

November 05, 2020

-

What is Text Analysis?

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

-

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

-

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

-

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

-

Top 10 Chatbot Platforms

FEATURE | By Cynthia Harvey,

October 07, 2020

-

Finding a Career Path in AI

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

-

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

-

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

-

Top 10 Machine Learning Companies 2020

FEATURE | By Cynthia Harvey,

September 22, 2020

-

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

-

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

-

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

-

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

-

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

-

Anticipating The Coming Wave Of AI Enhanced PCs

FEATURE | By Rob Enderle,

September 05, 2020

-

The Critical Nature Of IBM’s NLP (Natural Language Processing) Effort

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

August 14, 2020

SEE ALL

CLOUD ARTICLES