Public cloud companies crossed a big milestone during the second quarter (Q2) of 2017, according to International Data Corporation’s (IDC) latest research.

The public cloud now accounts for just over a third (33.5 percent) of worldwide IT infrastructure sales, a 34.1-percent year-over-year increase. Revenue totaled $8.7 billion.

Cloud Storage and Backup Benefits

Protecting your company’s data is critical. Cloud storage with automated backup is scalable, flexible and provides peace of mind. Cobalt Iron’s enterprise-grade backup and recovery solution is known for its hands-free automation and reliability, at a lower cost. Cloud backup that just works.

For comparison’s sake, the public cloud claimed a 27-percent share of the overall market. Servers, data storage systems and Ethernet switches all fall under the IT infrastructure category at IDC.

Private cloud generated $3.7 billion in sales during Q2, an annual increase of nearly 10 percent. Combined, public and private cloud IT infrastructure sales have nearly tripled in the last four years, noted the research firm.

Demand from traditional or non-cloud customers keeps slipping, shedding 3.8 percent in Q2 on an annual basis. Nonetheless, the segment remains an important one, generating $13.6 billion in Q2 and representing more than half (52.4 percent) of the market.

Storage is in high demand, accounting for over a third of public cloud revenues in Q2, a 30.4-percent year-over-year increase. Sales of both Ethernet switches and servers rose 26.8 percent and 24.6 percent, respectively.

Amazon is the driving force behind the accelerated spending, noted Kuba Stolarski, research director at IDC’s Computing Platforms practice. Its rivals aren’t sitting still, however.

In prepared remarks, Stolarski said “it is important to remember that many of the other hyperscalers – Google, Facebook, Microsoft, Apple, Alibaba, Tencent, and Baidu – are preparing for their own expansions and Skylake/Purley refreshes of their infrastructure.” Skylake and Purley are newer processor architectures for high-performance servers from chipmaking giant Intel that cloud providers can use to speed up their workloads.

“At the same time, IDC is still seeing steady growth in the lower tiers of public cloud, and continued growth in private cloud on a worldwide scale,” continued Stolarski. “In combination, these infrastructure growth segments should more than offset the declines in traditional deployments for the remainder of 2017 and well into next year.”

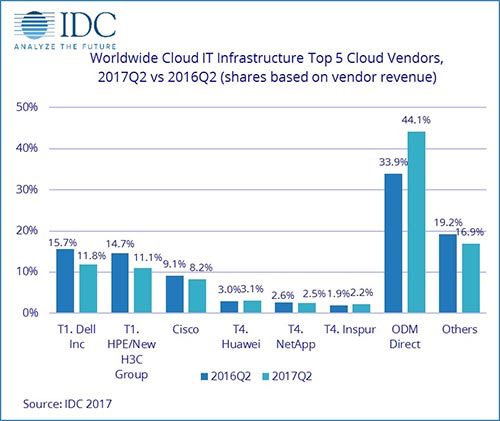

Dell holds a slim lead, with 11.8 percent of the market on cloud IT infrastructure sales of over $1.4 billion. HPE is close behind with an 11.1-percent share of the market and over $1.3 billion in revenue.

Cisco takes third place, with just over a $1 billion in sales and 8.2 percent of the market. Huawei, NetApp and Inspur round out the top five vendors. Collectively, ODMs (original design manufacturers) that sell directly to data center customers outpace them all, with $5.4 billion in sales during Q2 and 44 percent of the market.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.