The cloud–based Business Intelligence juggernaut is picking up speed. The financial reports of vendors plus a new survey by Dresner Advisory Services make it clear that a majority of enterprise applications decision makers is getting more comfortable with the security and control issues of cloud-based BI.

Howard Dresner, among the first to use the phrase business intelligence, gave me an advance preview of the upcoming “Wisdom of Crowds Business Intelligence Market Research” report based on a survey he conducted earlier this year.

Cloud Storage and Backup Benefits

Protecting your company’s data is critical. Cloud storage with automated backup is scalable, flexible and provides peace of mind. Cobalt Iron’s enterprise-grade backup and recovery solution is known for its hands-free automation and reliability, at a lower cost. Cloud backup that just works.

This year’s report includes responses from almost 1,200 respondents from around the world. Roughly one third of the respondents were from IT, the rest from management or various functional areas, such as finance, marketing, sales and R&D.

Note that while six out of ten respondents were from the U.S., the survey received substantial participation from individuals in Europe and Asia. While the majority of respondents were from companies with less than 1,000 employees, the 42 percent from larger organizations provides a lot of insights into the deployment plans of large organizations.

And these views about cloud-based BI adoption are much more prevalent than even Dresner had anticipated. One of the big surprises was the growing interest in cloud-based BI—”I had thought interest in cloud had gone sideways this year, but it actually increased,” he noted.

Indeed, roughly 75 percent of the respondents said that cloud or SaaS BI was important to their organizations. Roughly a sixth of respondents said it was critical for their organizations, while almost a fifth said it was very important. In contrast, Dresner noted that a year earlier only 10 percent of the survey respondents said cloud-based BI was “critical” to their organizations.

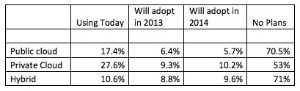

In fact, by 2014 roughly three quarters of the respondents’ organizations will have adopted some sort of cloud-based BI. It will come as no surprise that private cloud BI will continue to be the most common cloud platform, as this table shows:

(Note: Respondents could select more than one cloud option.)

Source: 2013 Wisdom of Crowds Business Intelligence Market Research, Dresner Advisory Services

Of course, marketing, sales and other end user departments, especially in smaller organizations, are leading the cloud-based BI parade. As you would expect, finance is the least likely department to wander off the on-premise BI reservation.

All the cloud embracers have one key attribute and attitude in common. “Whenever there is a constituency underserved by IT, those departments will be among the first to seek out a cloud/SaaS solution,” Dresner explains. IT pros essentially brought this cloud/SaaS problem on themselves by not providing the easy to deploy and inexpensive solution to their corporate clients’ operational challenges.

Money Drives this Juggernaut

A major factor driving the interest in cloud-based BI is cost. The pay-as-you-go model of many SaaS providers avoids a lot of the shelfware issues endured by large companies that failed to properly train their employees in how to use the software. While it is true that these SaaS buyers may be ignoring the total cost of ownership benefit of a large, fully integrated on-premise implementation, the end users don’t want to know or just don’t care.

However, the speed of adoption of the different business model by the traditional BI vendors could accelerate increased use of the cloud platform, if they can solve their major business model headache and challenge. They need to maintain their existing perpetual license model for existing customers in order to retain their current revenue flows and support their R&D and tech support, while at the same time responding to the competitive pressure from the SaaS vendors.

Interestingly, the difference between the traditional BI vendors and the new SaaS Bi upstarts is not really about new features or functions or other capabilities. “For the big vendors,” Dresner says, “their problem is not technological innovation but their existing business model—they don’t want to cannibalize their existing revenue streams.”

Based on a lot of research and discussions I have had with vendors and their consultants, the business model challenge will not be resolved anytime soon. It will take years for the large traditional BI providers to fully incorporate a coherent pricing program that will address the cognitive dissonance of their end user customers – these customers see the ultra-low cost app stores from Apple and Google and wonder why enterprise software costs so much.

While vendors may consider the comparison ridiculous, the perception of the value of enterprise software among end user customers has been severely challenged. And the traditional vendors will respond with a variety of techniques that will only accelerate the rise of cloud/SaaS based BI over the next several years.

Note that Dresner’s full BI report will be available in mid May. You will be able to find it at Dresner Advisory Services.