We need a new candidate for the title “Most Loathed Enterprise Application Software,” hereafter known as MLS.

Three decades ago, the tortured (read: costly and disruptive) implementations of enterprise resource planning systems practically made the three-letter acronym ERP an epithet worthy of being banned by the Federal Communications Commission. Then the phrase Y2K rose to the top of the MLS list a decade ago, when many organizations had to rework or replace their enterprise applications.

And ever since then, sales force automation software was considered the MLS – created by non-sales types, with a user-hostile interface and with little to no discernible benefit for the end users. Sales people were ordered to use clunky software to submit a lot of information so that management could track them even more closely. Really?

Yet things have changed. While SFA still doesn’t rank with sliced bread or the iPhone as universally beloved, the software application is definitely off the MLS list, according to a new survey of sales professionals by Ventana Research, an authoritative and respected benchmark business technology research and advisory services firm.

While only 233 sales managers, sales executives, sales representatives and sales IT specialists participated in the summer and fall 2011 poll, the data are overwhelming: 61% percent said that they were either very satisfied or satisfied with their SFA. Only 8% said they were not satisfied, a sea change from the dawn of the SFA era 25 years ago, notes Mark Smith, CEO and Chief Research Officer of Ventana Research.

“Yes, there have been challenges over the decades,” acknowledges Smith, a statement that certainly qualifies as an early candidate for understatement of the year. SFA software was notoriously hard to use and frequently ignored by the sales teams. Of course, generations of sales people have been reluctant to submit call reports, and automating the recording of telephone calls, meetings, proposals submitted and other sales tasks didn’t help the situation when the interface was clunky and the systems were managed by IT departments not renowned for agility.

Smith notes that while actual SFA software adoption and use rate data are hard to come by, it is clear that satisfaction has been growing substantially in the three years since the prior Ventana poll on SFA.

High satisfaction with SFA is all about ease of use. Not just a better UI, but the availability of cloud-based SFA that a sales manager can easily buy, configure and deploy drives the new status of SFA.

Roughly half of the Ventana Research survey respondents are customers of salesforce.com and they are happy campers. The almost constant upgrading of the Software as a Service (SaaS) version of SFA is in sharp contrast to the annual or every other year upgrade of on premise applications, notes Smith. “There is an even higher satisfaction correlation with customers using salesforce.com,” he adds.

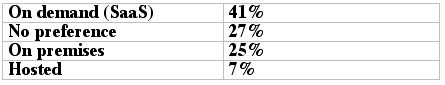

The high rate of satisfaction with SFA these days, especially if it is cloud-based, explains a shocking set of data points: only 25% of the survey respondents prefer an on-premises SFA implementation. More than four out of 10 prefer the cloud-based approach, while another quarter have no preference (see table).Enthusiasm for cloud-based SFA has increased dramatically since Ventana did its prior SFA poll in 2008.

Source: Ventana Research

“There’s been a very significant shift,” explains Smith. “In most sales organizations, people or time is the most valuable asset. If a salesperson can get access to an application really fast, they can contribute to the top line faster. SaaS offers the ability for sales organizations to be agile and engage prospects quickly, without having to worry about long IT development and deployment cycles.Also, don’t forget that IT departments are not getting bigger – they’re getting smaller, so sales will get less support. That’s why you saw the huge preference for SaaS. We’ve been measuring this shift for four and a half years.”

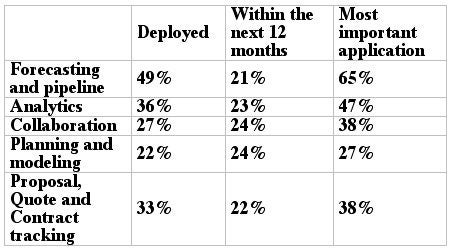

The newfound enthusiasm for SFA has led to strong interest in augmenting their basic functionality. Near the top of the wish list agenda for SFA users is analytics. Managers and executives believe that knowing more about pipeline status, order patterns, success rates and other metrics will help them achieve their two highest sales priorities – increasing revenues and enhancing sales effectiveness.

Here’s a table that indicates some of the most popular SFA augmentations on the short-term priority list:

Source: Ventana Research

Don’t think that a 61% satisfaction rating means that everything is peachy keen in the world of SFA. The rise of SaaS and several other factors has led to some data integration challenges. Finding sales-related information – RFPs, RFIs, proposals, PowerPoint decks and the rest of the stuff in the 21st century Willy Loman’s briefcase – is often a major headache, along with the integration of an organization’s ERP data with a cloud-based SFA.

“Making it easier to synchronize data among applications is one of the top three issues companies face,” Smith says. “Everyone is enamored with the usability of cloud-based apps, but they forget about the synchronization.”

Another impediment is the Frankenstein monster in the room (Full disclosure—I borrowed this idea from Ventana, which is using this image in its upcoming survey presentation). The majority of organizations continue to use spreadsheets to manage their sales operations, at least occasionally. And almost half of the survey respondents say “reliance on spreadsheets made it difficult for sales to manage efficiently.”

The Ventana poll indicates that the reliance on spreadsheets as a SFA tool is declining, but the pace is glacial. It will take decades to fix this.

Let’s hope it takes less time than the improving of SFA.