In July when VMware acquired network virtualization startup Nicira for more than $1 billion, VMware showed that it’s serious about being as big of a player in the cloud’s future as it has been with the cloud’s enabling technology, virtualization.

VMware declined to discuss their cloud roadmap with me for this story, but as the cliché goes, actions speak louder than words. And VMware’s recent cloud actions are revealing.

You don’t spend a billion dollars to be a bit player. The trouble is, VMware is going up against giants like Amazon and Google who have a head start – a serious head start in Amazon’s case. And there are a slew of other serious contenders, such as Rackspace, Eucalyptus, Microsoft and Citrix (especially after its acquisition of Cloud.com).

Where VMware Stands Now

So before we look at the roadmap, let’s look at where VMware is now. Virtualization, of course, is the enabling technology that made this cloud revolution feasible. Sure, IT curmudgeons will tell you that the idea of the cloud has been around for years, but it wasn’t practical until virtualization matured.

VMware’s cloud centerpiece is vCloud, which serves as a foundation for building clouds. vCloud competes directly with the Citrix-led CloudStack and with the open source project OpenStack. Muddying the waters, VMware just joined the OpenStack Foundation as a gold member (more on this later).

VMware’s open PaaS solution, Cloud Foundry, shows promise but is still in beta. It will also face stiff competition from established PaaS players, including IBM, Amazon AWS, Red Hat, Salesforce.com, Microsoft and Google. That’s not a list of lightweights.

Where VMware’s cloud potential really starts to shine, though, is with its recent cloud acquisitions, the most important being Nicira, a pioneer of software-defined networking (SDN).

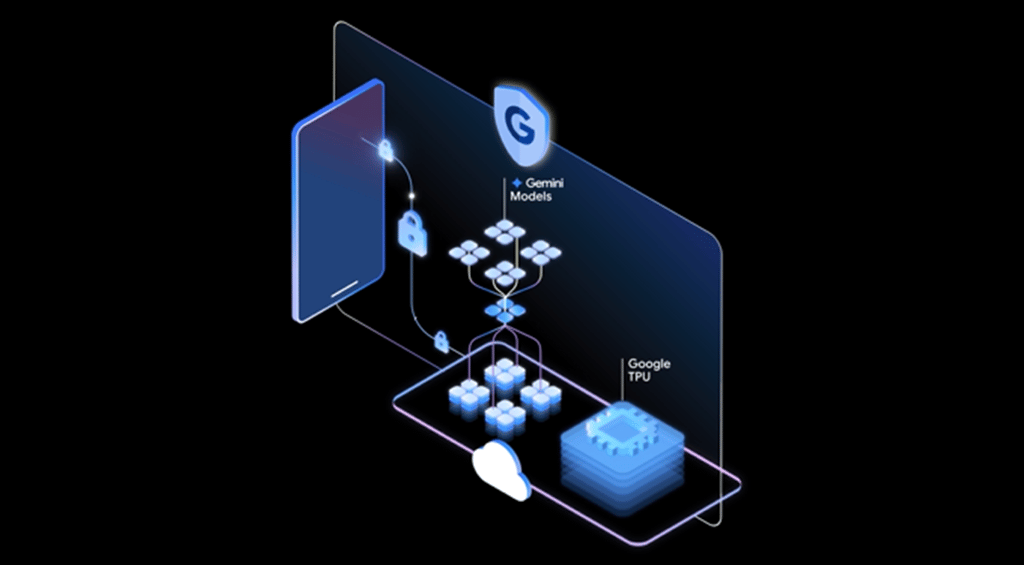

With SDN, the network itself is what is being virtualized. Just as server virtualization decoupled apps from hardware, so too does network virtualization decouple network services and operational control from network hardware. Thus, any available physical network can be transformed into an IP backplane. These virtual networks can then be provisioned to deliver all of the same features of physical networks, but with operational flexibility.

This isn’t trivial. It opens the door (along with virtualized compute and virtual storage) to software-defined data centers.

Nicira isn’t VMware’s only cloud acquisition, but it is the most important. Other cloud-related acquisitions include DynamicOps (cloud automation and management), Cetas Software (Big Data analytics), B-Hive Networks (application performance management), Wanova (virtual desktop management), and Shavlik Technologies (cloud-based IT management). VMware also purchased Log Insight, a cloud analytics platform, from data management vendor Pattern Insight.

First Obstacle Emerges: Management

What’s the common denominator amongst these acquisitions, other than that in one way or another they all relate to the cloud? The common denominator is management.

And that’s where trouble starts brewing. “Each new acquisition fragments VMware’s cloud management capabilities,” said Shmuel Kliger, CTO of VMTurbo. “VMware is repeating the mistakes made by traditional IT systems management vendors.”

The difference is that when HP, BMC and IBM cobbled together their solutions for managing the non-virtualized data center from an array of point products, data silos were the norm. Enterprises could handle these point products because they already had different storage, networking and server teams, and while everyone paid lip service to breaking down silos, nobody saw this as a huge impediment.

In a software-defined data center, management and data silos pose real problems and seriously undermine efficiency. Kliger isn’t a disinterested party here. VMTurbo provides cloud operations management tools, and, of course, it’s in their best interest to alert people to any cracks in VMware’s cloud management foundation. Nonetheless, his argument is a valid one.

“Instead of solving the management problem, they created a management nightmare. Moreover, most of these tools focus on collecting data – a lot of detailed data – that could be used to alert administrators and generate reports,” Kliger said. “Not only does the collected data not solve anything, but it creates a whole new problem: a Big Data problem.”

With all this data piling up, it must be stored, managed and somehow assessed. With more tools collecting more information, it becomes difficult to extract meaning from the Big Data avalanche.

The Pricing Problem

Another issue with VMware’s cloud strategy is that it recently changed its pricing model. VRAM pricing has been an issue for some time.

Last year, VMware rolled out a new pricing model that charged customers based on the amount of virtual infrastructure, not physical infrastructure, they used. Thus, customers who succeeded in consolidating virtual machines (VMs) onto a few servers were penalized.

At VMworld this year, after vocal complaints from customers, VMware announced that it was doing away with this. It will now charge the old-fashioned way: per-CPU and per-socket.

However, I spoke with an executive at a service provider who complained that the new pricing is not being extended to the VMware Service Provider Program (VSPP).

My source wished to remain anonymous, but he said that now it is service providers, and especially hosting providers, who will be penalized.

“This means that the price service providers give to customers for virtual machines or hosted servers will remain high. The big guys will just move to open source because it’s going to be hard to compete as a VMware service provider paying this memory tax,” he said.

Even the new pricing could be seen as flawed. Eventually, virtualization and the cloud move pricing to a utility model, and the per-CPU model, while probably more profitable for VMware, seems antiquated, a remnant of the shrink-wrap software days.

And don’t be surprised if VMware gets more pushback and changes its pricing model yet again.

My source believes that what is happening is that VMware will try to own a very specific cloud segment: private clouds, but more specifically, large enterprise on-premise private clouds.

“This move is already opening up a lot of real estate for Xen and Microsoft Azure,” he said. “Who’s going to serve SMBs? It sure doesn’t look like VMware will be attractive in any but the largest environments.”

That may not be a bad thing from VMware’s point of view. SMBs are aggressively moving to public clouds, and the public cloud game is already dominated by entrenched providers like Amazon, Google and Rackspace.

Meanwhile, pretty much every hosting provider on the planet is rolling out cloud services. Downward price pressure will be the norm. On-premise private clouds for large enterprises are probably a better bet, and that appears to be where VMware is placing its chips.

The OpenStack Controversy

A final complicating factor on VMware’s cloud roadmap is OpenStack. Just this past April, Mathew Lodge, VMware’s VP of Cloud Services, argued that OpenStack was one of vCloud’s ugly sisters. (The other ugly sisters according to Lodge were CloudStack and Eucalyptus.)

What a difference a few months (or rather a single acquisition) make. Now, after the Nicira acquisition, VMware has taken a shine to one of those ugly sisters. Nicira was heavily involved in OpenStack, and OpenStack uses Nicira’s API for its network interface.

There was some public dissent about letting VMware into the OpenStack Foundation. Boris Renski, EVP of cloud startup Mirantis, an OpenStack gold member, believes this is a Sun Tzu-style move on VMware’s part. On the Mirantis blog, Renski focused on a tweet by @cloud_borat: “‘The supreme art of war is to subdue the enemy without fighting.’ – Sun Tzu – In other news @VMware joins @openstack.”

The OpenStack founders I spoke with didn’t feel this way, but you never know, it’s still early.

“Boris was one of two board members to vote against VMware. Two out of twenty-four,” said Josh McKenty, a co-founder of OpenStack and the CEO of Piston Cloud Computing.

“Look at hypervisors, they [VMware] have 90 percent market share. Every cloud has a hypervisor in it somewhere. VMware is in best position to make all of that work, and when we talk to end users, they all tell us they want VMware in OpenStack,” he said.

Which brings us back to management.

Basically, with the Nicira acquisition, VMware has all of the pieces for a compelling software-defined data center vision. VMware’s own portfolio virtualizes compute. Nicira virtualizes the network, and VMware has plenty of storage options, everything from vSphere virtual storage to parent company EMC’s cloud storage products to certified partners like StorSimple.

That’s a pretty compelling end-to-end portfolio. VMware has a lot of work to do if it wants to dominate clouds, even enterprise private clouds, the way it dominates the virtualization landscape. But if nothing else, it’s already carved out a high-margin cloud niche for itself, and the Nicira and DynamicOps acquisitions point towards a serious hybrid cloud play down the road.

The likes of Amazon and Google probably aren’t terribly worried by any of this, but competitors like Citrix, Cisco, Dell and HP most certainly are.

-

Ethics and Artificial Intelligence: Driving Greater Equality

FEATURE | By James Maguire,

December 16, 2020

-

AI vs. Machine Learning vs. Deep Learning

FEATURE | By Cynthia Harvey,

December 11, 2020

-

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

-

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

-

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

-

Top 10 AIOps Companies

FEATURE | By Samuel Greengard,

November 05, 2020

-

What is Text Analysis?

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

-

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

-

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

-

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

-

Top 10 Chatbot Platforms

FEATURE | By Cynthia Harvey,

October 07, 2020

-

Finding a Career Path in AI

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

-

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

-

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

-

Top 10 Machine Learning Companies 2021

FEATURE | By Cynthia Harvey,

September 22, 2020

-

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

-

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

-

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

-

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

-

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

SEE ALL

CLOUD ARTICLES