New data released today from the technology analysts at Synergy Research Group contains positive news for cloud providers and the vendors that outfit their data centers. “Across a range of cloud market segments, 2015 growth rates averaged 28 percent and annual revenues passed the $110 billion milestone,” John Dinsdale, Synergy Research Group chief analyst, told […]

Datamation content and product recommendations are

editorially independent. We may make money when you click on links

to our partners.

Learn More

New data released today from the technology analysts at Synergy Research Group contains positive news for cloud providers and the vendors that outfit their data centers.

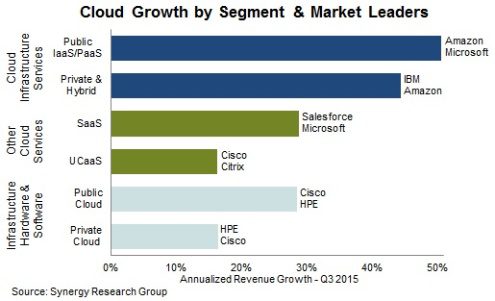

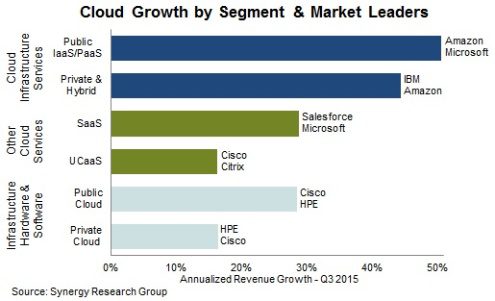

“Across a range of cloud market segments, 2015 growth rates averaged 28 percent and annual revenues passed the $110 billion milestone,” John Dinsdale, Synergy Research Group chief analyst, told Datamation. The firm drew its conclusions from the four quarters ending Sept. 30, 2015.

“Among the segments, public IaaS/PaaS [infrastructure-as-a-service/platform as a service] saw the highest growth rates, but cloud infrastructure hardware and software still generate the most revenues at the moment,” continued Dinsdale. Combined, the public IaaS and PaaS market segments, led by Amazon and Microsoft, grew at a blistering rate of 51 percent.

The private and hybrid cloud infrastructure services segment wasn’t too far behind, with a growth rate of 45 percent. IBM and Amazon were the top performers in the category. In total, all segments grew at a rate of at least 16 percent, observed Synergy.

In the software-as-a-service (SaaS) segment, Salesforce and Microsoft are battling it out for dominance. Computer networking giant Cisco and Hewlett Packard Enterprise (HPE) are the vendors to beat in the public and private cloud infrastructure hardware and software segments.

Cisco was also named a leader in the unified-communications-as-a-service (UCaaS) category, alongside Citrix. According to another report released yesterday by Synergy, the UCaaS market is growing 16 percent annually, with annualized revenues now totaling $4 billion.

Cisco, Citrix and Microsoft are the top three providers of standalone UCaaS applications, a category that includes cloud-delivered videoconferencing, Web conferencing and hosted contact center software. In integrated UCaaS business suites, a segment that is growing at 23 percent annually, RingCentral, 8×8 and Vonage take the lead.

During the four quarters tracked by Synergy, cloud services infrastructure hardware and software spending surpassed $60 billion, driven by private cloud spending although the public cloud is catching up quickly.

Cloud services providers generated $20 billion from infrastructure services (IaaS, PaaS, private and hybrid cloud services), during the 12-month survey of the market. SaaS accounted for $27 billion in cloud spending.

In the face of such lofty figures, the message to the IT industry is clear, according to Dinsdale. “Cloud has now passed way beyond the early adopter phase and is truly a mainstream phenomenon,” he said. “High growth rates will persist for many more years.”

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

- Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

- Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

- Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

- Top 10 AIOps Companies

FEATURE | By Samuel Greengard,

November 05, 2020

- What is Text Analysis?

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

- How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

- Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

- The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

- Top 10 Chatbot Platforms

FEATURE | By Cynthia Harvey,

October 07, 2020

- Finding a Career Path in AI

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

- CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

- Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

- Top 10 Machine Learning Companies 2020

FEATURE | By Cynthia Harvey,

September 22, 2020

- NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

- Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

- Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

- IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

- Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

- Anticipating The Coming Wave Of AI Enhanced PCs

FEATURE | By Rob Enderle,

September 05, 2020

- The Critical Nature Of IBM’s NLP (Natural Language Processing) Effort

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

August 14, 2020

SEE ALL

CLOUD ARTICLES