As cloud-based technologies dominate the industry, data is integral to all business functions, operations, and decisions. Therefore, there is a constant need for improved tools and technologies that help store and analyze data better and improve business processes.

Data warehouse software and tools help improve data extraction, cleaning, and transformation. They also help consolidate data and update information from data sources. A data warehouse acts as an intelligent data repository developed by incorporating data from numerous heterogeneous sources for better analysis and gaining useful insights.

What Is a Data Warehouse?

A data warehouse system is a part of the organizational data ecosystem. It is designed to aggregate data from multiple internal and external sources. Using a relational database, it organizes and stores data for further analysis. A data warehouse, therefore, acts as a central data source that fuels a decision support system through its data visualization, presentation, and analytics capabilities.

As per reports, around 54% of organizations have adopted data warehousing. It is expected that this highly adopted data solution will reach a global market value of $51.18 billion USD by 2028.

What Are Data Warehouse Software and Tools?

Data warehouse tools act as an essential component of data analytics and big data. They are often used with extract, transform, and load (ETL) tools for predictive analysis, business intelligence, and data standardization. The technologies that empower these tools to perform efficiently are artificial intelligence (AI) and machine learning.

As businesses deal with an enormous volume of data, it is necessary to collect, clean, and organize the information for easier management and analysis. Data warehouse tools and software rely on advanced technologies like data management system and analytics (DMSA), data management and analytics (DMA), and database management systems (DBMS).

Why Use Data Warehouse Software and Tools?

As the data warehouse contains information from multiple sources, there is a need to integrate and streamline this diverse information. Data warehousing solutions require the automation of repetitive tasks to boost performance.

Data warehouse software and tools help in the ETL process to facilitate smooth data movement within different tiers of the warehouse architecture. The ETL process involves:

- Extraction: Raw data is retrieved from different sources and can be in different formats like JSON, XML, and relational databases.

- Transformation: This extracted data needs to be processed based on business requirements. As there can be different formats and structures of data, in the transformation process, the retrieved data is cleaned, formatted, and structured to maintain consistency.

- Loading: Data is delivered to the warehouse and secured for internal and external use.

Thus, the top business benefits of using data warehouse software and tools are:

- Enhanced business intelligence.

- Improved performance.

- High-quality, consistent, and consolidated data.

- Time-efficient decision-making.

There are a huge number of data warehouse software and tools available in the market. But, it is important to consider their capabilities and the value they add to businesses when deciding on the top tools for data warehouse requirements.

This guide offers a comprehensive list of the best data warehouse software and tools available in the market, highlighting their best features to help you make the right choice.

- AWS Redshift: Best for real-time and predictive analytics

- Oracle Autonomous Data Warehouse: Best for autonomous management capabilities

- Azure Synapse Analytics: Best for intelligent workload management

- IBM Db2 Warehouse: Best for fully managed cloud versions

- Teradata Vantage: Best for enhanced analytics capabilities

- SAP BW/4HANA: Best for advanced analytics and tailored applications

- Google BigQuery: Best for built-in query acceleration and serverless architecture

- Snowflake for Data Warehouse: Best for separate computation and storage

- Cloudera Data Platform: Best for faster scaling

- Micro Focus Vertica: Best for improved query performance

- MarkLogic: Best for complex data challenges

- MongoDB: Best for sophisticated access management

- Talend: Best for simplified data governance

- Informatica: Best for intelligent data management

- Arm Treasure Data: Best for connected customer experience

AWS Redshift: Best for Real-Time and Predictive Analytics

Amazon Redshift is a simple and cost-effective data warehouse platform that helps with efficient data analysis at the enterprise level. AWS has established itself as a global leader in cloud infrastructure and platform services, gaining the trust of millions of customers.

Amazon Redshift offers real-time and predictive insights for optimized business intelligence. It has top features like automated infrastructure provisioning, quick data processing, and flexible data querying, and it can easily accommodate intensive workloads with its efficient machine-learning capabilities.

AWS Redshift is suitable for enterprises of any scale, whether a startup, midsize business, or even a Fortune 500 company. It has customers across all industry verticals like retail, manufacturing, telecommunications, media and entertainment, and software.

Amazon Redshift has been recognized as a top product by software review websites like TrustRadius, Gartner, and G2. Overall, users are quite satisfied with AWS Redshift. It has an average 4+ rating out of 5 and is recommended by most users.

Visit Amazon

Key Features

- Real-time and predictive analytics.

- Elastic scaling.

- Automated backups.

- Federated query capability.

Pros

- Quick, effortless, and secure data warehousing.

- Customer-driven, releasing hundreds of improved features annually.

- AWS service integration makes accelerating migration to Amazon Redshift easier.

Cons

- It needs configurations and is not a 100% managed service.

Pricing

The starting price for AWS Redshift is $0.25 per hour.

Oracle Autonomous Data Warehouse: Best for Autonomous Management Capabilities

Oracle offers cloud-based data warehousing services through Oracle Autonomous Data Warehouse. Oracle runs entirely on its own cloud infrastructure and has in-built self-service tools that enhance productivity. It offers highly sophisticated and capable data management products.

Oracle Autonomous Data Warehouse is optimized for analytic workloads. It boosts organizational productivity and considerably lowers operational costs, as it helps monitor different aspects of system performance.

Large enterprises with multiple workloads and robust budgets usually prefer Oracle Data Warehouse solutions. It has geographically distributed architectures that accelerate customer deployment.

Oracle Autonomous Warehouse has been recognized with many honors. It was the CRN’s Products of the Year Overall Winner in 2020. And per Wikibon, it is the best tier-1 cloud-based data warehouse platform. Users of top software-reviewing websites have awarded Oracle Autonomous Warehouse with more than 4 out of 5 stars. Thus, it is a top-rated product.

Visit Oracle

Key Features

- Autonomous management capabilities.

- Transparent data encryption.

- Easy connectivity with third-party products.

- Built-in ETL and key performance indicator (KPI) metrics.

Pros

- High-level functionality with easy integration capabilities.

- Fully managed relational database.

- Highly flexible scaling.

Cons

- Pricing for Oracle Autonomous Data Warehouse is expensive.

Pricing

Oracle offers on-demand pricing, starting from $1.3441 per hour.

Microsoft Azure Synapse Analytics: Best for Intelligent Workload Management

In 2010, Microsoft launched its cloud computing platform, Azure. Currently, it offers more than 200 products and services. There are different data storage, big data systems, data analytics, and business intelligence tools that help eliminate data barriers and offer powerful insights.

Azure Synapse Analytics has unified enterprise warehousing and big data analytics to offer limitless analytics services. It delivers enormous value with petabyte-scale analytics and multi-layered security.

Small and midsize businesses (SMBs) and large enterprises from financial services, manufacturing, retail, and healthcare sector use Azure Data Warehouse solutions.

Azure Synapse Analytics is the top choice for leading companies like Walgreens, Marks & Spencers, Co-op, ClearSale, Neogrid, and CCC Marketing. It can generate millions of predictions within seconds. On average, Azure Synapse Analytics has been rated with a 4 out of 5 stars by users. Most consider it an all-in-one tool that effectively meets business data analytics needs.

Visit Azure

Key Features

- Intelligent workload management.

- Unified environment for analytics and machine learning tasks.

- Top-performing Apache Spark and SQL engines for improved collaboration.

- Distributed query engine for log and telemetry analytics.

Pros

- Complex pipelines can be monitored easily.

- Powered by diverse transformation tools.

- Comprehensive services with efficient AI integration.

Cons

- Support for serverless architecture is not available.

- The pricing structure is complex.

Pricing

It costs $5 USD per terabyte (TB) of data processed. In Tier-1, the starting price is $4,700 per 5000 Synapse Commit Units, or SCUs.

IBM Db2 Warehouse: Best for Fully Managed Cloud Versions

The technology giant IBM has developed high-performance data warehouse solutions that can collect, streamline, and analyze enormous volumes of data. It has been recognized globally for its cloud-based solutions and vertical data models.

IBM Db2 Warehouse helps businesses manage fluctuating analytics workloads with real-time analytics. It is a fully managed, elastic, cloud-native data warehouse that supports massive-scale data sharing and processing.

IBM is a top preference for large enterprise customers in search of simplified data warehouse administration and maintenance. It has customers from different industry verticals like healthcare, tourism and travel, and banking and finance.

In the G2 Summer 2022 Grid Report, IBM Db2 was recognized as a leader in data warehousing solutions. It is also top-rated in TrustRadius. IBM Db2 has an average user rating of 4 out of 5 and is considered as a well-integrated database option with highly responsive data management capabilities. It can be easily integrated into the IBM ecosystem and is extremely reliable.

Visit IBM

Key Features

- Fully-managed cloud version.

- Effortless scaling based on resource demands.

- Load time improved by 50%.

- Secure and collaborative analytics.

Pros

- End-to-end security capabilities.

- Responsible data sharing.

- On-premises warehouse compatibility.

Cons

- Dashboard features can be enhanced.

Pricing

IBM Db2 has flexible pricing plans. The starting price is $898 per month.

Teradata Vantage: Best for Enhanced Analytics Capabilities

Teradata has a mature and sophisticated product portfolio with a wide range of advanced cloud-based solutions ideal for hybrid as well as multicloud infrastructures.

Teradata Vantage is best for enterprise analytics and delivers unlimited intelligence with multi-dimensional scalability. It can handle massive workloads and eliminates complicated data management with advanced workload management solutions.

Teradata Vantage has customers across different industries. Enterprises from automotive, healthcare, manufacturing, media and entertainment, retail, utilities, manufacturing, and other sectors rely on Vantage’s easy-to-use advanced analytics.

In the Gartner Magic Quadrant for Cloud DBMS, Teradata Vantage has been recognized as a leader. Besides, it is the most flexible data platform that can be deployed on public clouds as well as on-premises. Teradata Vantage has an average 4-star user review. It is fast, with excellent native features and automation.

Visit Teradata Vantage

Key Features

- Connected multicloud platform.

- AI and machine learning-powered models.

- Significantly enhanced Clearscape Analytics capabilities.

Pros

- Industry-leading analytics with fast and flexible data access.

- Pay-as-you-go pricing.

- Fast and flexible data access.

Cons

- Ideal only for large-scale businesses.

Pricing

Teradata Vantage has a consumption-based pricing model. The enterprise pricing plan starts from $9,000 per month.

SAP BW/4HANA: Best for Advanced Analytics and Tailored Applications

SAP is a premier name in the global software market. It has extensively networked with major cloud service providers and developed leading products and solutions.

SAP BW/4HANA offers cloud and on-premises deployment solutions for data warehousing. It can enable intelligent automation with real-time data processing. With these capabilities, SAP BW/4HANA is suitable for human capital management, supply chain management, customer relationship management, and enterprise resource planning and finance.

SAP BW/4HANA is a next-generation data warehouse solution that supports innovation and helps boost business performance by driving return on investment (ROI). It is widely trusted by industry experts and consultants. SAP BW/4HANA has a 4-star rating on average. As per users, it is a comprehensive solution for the data warehousing needs of businesses.

Visit SAP

Key Features

- Easily integrates with both SAP and non-SAP applications.

- Built-in predictive analysis.

- Advanced analytics and tailored applications as per business needs.

Pros

- Enhanced performance with AI and machine learning technologies.

- Reduced shadow analytics.

- Intuitive user experience.

Cons

- Expensive license pricing.

Pricing

SAP BW/4HANA pricing plans are available on direct request.

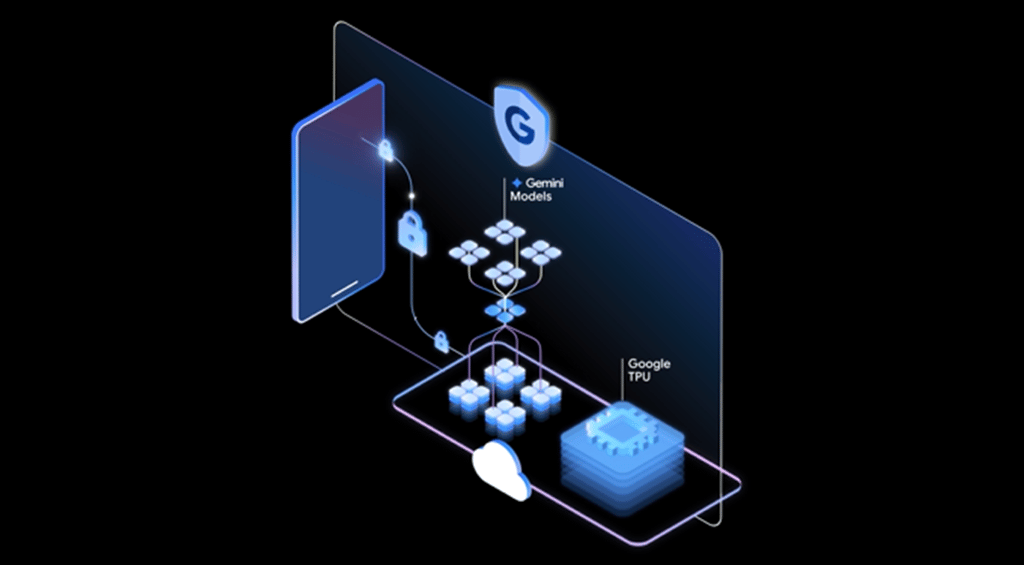

Google BigQuery: Best for Built-In Query Acceleration and Serverless Architecture

Undoubtedly, Google is a dominant search engine. But, it has also designed extensive cloud-based solutions for data management and dominated the market.

Google BigQuery is a cloud data warehouse that empowers businesses in data-driven innovation. This business-class tool has in-built machine learning capabilities and can analyze massive datasets using SQL queries.

Google BigQuery is globally adopted by businesses from different industries like retail, financial services, media and entertainment, healthcare and life sciences, and even government agencies.

It is a top-rated product inTrustRadius. Besides, it is affordable, so it is a popular choice for businesses of all scales and sizes. Users have rated Google BigQuery with mostly 4-star ratings and higher. Its fast querying feature allows efficient data management. Some reviewers consider it an end-to-end data warehousing tool that can easily suit different business requirements.

Visit Google BigQuery

Key Features

- Flexible data ingestion.

- Built-in query acceleration.

- Serverless architecture.

Pros

- Cost-effective and secure data analysis.

- Event-driven analysis offers a competitive advantage to businesses.

- Automated backup and data restoration.

Cons

- It can be complicated to set up and integrate into business architecture.

Pricing

Google BigQuery offers on-demand pricing and flat-rate pricing. These models can also be combined as per business requirements.

Snowflake for Data Warehouse: Best for Separate Computation and Storage

Snowflake emerged as a top competitor in the technology market. It offers purely cloud-based solutions with unlimited resources that can drive thousands of organizations across different industries.

Snowflake for Data Warehouse requires nearly zero administration and can scale in seconds per business demands. It provides a seamless cross-cloud experience and can easily handle dynamic heterogeneous infrastructures.

Snowflake for Data Warehouse can manage workload for departments like marketing analytics, product development, IT, and finance. It has customers from different industries like advertising, media and entertainment, financial services, manufacturing, technology, public sector, healthcare, and retail.

KFC has appreciated Snowflake and expressed that it helps them generate reports in seconds. As per Peerspot, it ranks first in the list of top data warehouse tools. Users have mostly rated Snowflake for Data Warehouse with more than 4 out of 5 stars in different review websites.

Visit Snowflake

Key Features

- Native support for NoSQL databases.

- Centralized data from multiple sources.

- Fully separate computation and storage.

Pros

- Works in multicloud infrastructures.

- Simplified data processing.

- Fast analytics and reporting.

Cons

- Lesser scope for unstructured data.

Pricing

Snowflake offers a 30-day free trial worth $400. It has other plans for different business requirements that can be explored when requested on the official website.

Cloudera Data Platform: Best for Faster Scaling

This open-source platform helps businesses deploy modern data architectures. Cloudera accelerates digital transformation and aims to make data analytics easy and accessible for everyone.

Cloudera Data Platform offers a unified data fabric with ultimate flexibility in data management. Users can bi-directionally move data between data centers and multiple data clouds.

Cloudera is quite famous in the U.S. Majorly, businesses from the IT and service industry are its customers.

As per the 2022 Gartner Peer Insights, Cloudera Data Platform has been recognized as the Voice of the Customer. The GigaOm Performance Testing Report has also recognized Cloudera Data Warehouse as a leader. And Cloudera has received around 4-star ratings on different review platforms.

Visit Cloudera

Key Features

- 30x faster scaling capacity.

- Increased IT control with 60% higher ROI.

- Scalable data mesh and open data lakehouse.

Pros

- Portable data analytics.

- Consistent policy-based controls.

Cons

Pricing

Cloudera Warehouse pricing starts from $0.07 per CCU on an hourly basis.

Micro Focus Vertica: Best for Improved Query Performance

Micro Focus has developed a portfolio of enterprise software and services to modernize core business functions. It has developed Vertica Analytics Solution, which can efficiently store data and handle complex queries.

Vertica offers a broad set of analytical solutions based on a massively scalable architecture. This unified analytics platform operates across on-premises data centers as well as major cloud services.

Vertica is a suitable platform for virtually every industry dealing with data explosions, like AdTech, financial services, gaming, healthcare, IT, telecommunications, or utilities.

Vertica customers have eliminated about $4.4 million from prior data warehouse costs. As per Nucleus Research Report, for every dollar spent, Vertica customers get a value worth $4.07. As per users of top reviewing websites, Vertica gets an average of 4+ out of 5 stars.

Visit Micro Focus

Key Features

- Market-leading analytical database.

- Improved query performance.

Pros

- Efficient and intelligent scaling.

- Reduced storage and compute costs.

Cons

- Licensing is based on per TB.

Pricing

Those interested in Micro Focus Vertica should request a pricing quote.

MarkLogic: Best for Complex Data Challenges

MarkLogic has come up with a new-generational operational data warehouse that can efficiently simplify complex data challenges. It helps businesses eliminate data and knowledge silos to achieve data agility and unlock more value.

MarkLogic is preferred by SMBs from different industries like financial services, healthcare, insurance, life sciences, manufacturing, media and entertainment, and even public sectors.

In the KMWorld AI 50 2022, MarkLogic was listed for helping companies with intelligent knowledge management. Users have rated MarkLogic with 4+ out of 5-star ratings.

Visit MarkLogic

Key Features

- Faster data integration.

- Faster access to information.

Pros

- Reduced upfront and ongoing costs.

- Multi-model database powered by AI technology.

Cons

Pricing

MarkLogic pricing is available on direct request.

MongoDB: Best for Sophisticated Access Management

MongoDB helps build and manage data in the cloud environment. It has preconfigured security features and offers sophisticated access management to keep your data safe.

Currently, MongoDB has more than 37,000 customers across different industries, from financial services to telecommunications, manufacturing, and retail.

MongoDB has integrated with more than a hundred technologies and is truncated by top enterprises like Humana, Volvo, Thunkable, Forbes, Toyota, and many more. And it has been rated with more than 4 stars by most users.

Visit MongoDB

Key Features

- Easy cluster management.

- Secured database.

- Multicloud database.

Pros

- Documents stored in JSON format.

- No predetermined schema.

Cons

- Complex back-end architecture.

Pricing

MongoDB’s shared plan is available for a free trial. From there, the serverless model starts at $0.10 per million reads, and the dedicated plan is priced at $57 per month.

Talend: Best for Simplified Data Governance

Talend helps businesses make better decisions with superior analytics and data processing. It also offers data cleansing functions for simplified data governance.

Talend has users across different industries like agriculture, food and beverage, construction, education, finance, healthcare, real estate, services, and utilities.

Talend has been recognized as a leader in Data Quality Solutions in the 2022 Gartner Magic Quadrant, and most users have rated Talend with 4 stars or more on different review websites.

Visit Talend

Key Features

- Superior analytics for data preparation.

- Machine learning-aided quality controls.

Pros

- Self-service apps for simplified data management.

- Best-in-class data integration capabilities.

Cons

Pricing

Talend pricing plans can be accessed on direct request.

Designed to drive cloud data innovation, Informatica offers industry-leading data management solutions to accelerate analytics and AI projects. Intelligent Data Management Cloud (IDMC) is designed specifically for data management.

Informatica has been leading the market with its enterprise-grade data management solutions. It is also preferred by the majority of Fortune 100 companies.

Informatica has managed to garner the loyalty of its customers for twelve consecutive years. Users have rated Informatica with more than 4 stars in most review sites.

Visit Informatica

Key Features

- Intelligent data solutions driven by AI.

Pros

- Vast range of products and solutions.

- End-to-end data integration platform.

Cons

- Requires proper training prior to usage.

Pricing

Informatica offers a 30-day free trial. Customers can buy prepaid IPU subscriptions based on the capacity required.

Arm Treasure Data: Best for Connected Customer Experience

Customer Data Cloud is a Treasure Data solution that helps businesses create a connected customer experience and generate more sales at reduced costs. It analyzes millions of data points to create insights and predictions. Teams can make decisions based on these predictions.

Treasure Data has been able to drive profitable customer experience across different industries like consumer packaged goods, retail, financial services, entertainment, media, and publishing.

Treasure Data is truncated by hundreds of Fortune 500 and Global 2000 companies, and users have rated it with 4+ out of 5-star ratings.

Visit Treasure Data

Key Features

- AI-powered predictions.

- Helps businesses reclaim customer centricity.

Pros

- Flexible data set ingestion.

- Defined custom programming for special use cases.

Cons

- Onboarding could be smoother.

Pricing

Treasure Data pricing plans are available on request.

Comparing the Best Data Warehouse Tools

| Company |

Key Data Warehouse Tool |

Differentiator |

Pricing |

| Amazon Web Services |

Redshift |

Real-time and predictive analytics |

Starting from $0.25 per hour |

| Oracle |

Autonomous Data Warehouse |

Autonomous management capabilities |

Starting from $1.3441 per hour |

| Azure |

Azure Synapse SQL |

Intelligent workload management |

Starting from $4,700 per 5,000 SCUs |

| IBM |

Db2 Warehouse |

Fully managed cloud version |

Starting price from $898 per month |

| Teradata |

Vantage |

Significantly enhanced Clearscape Analytics capabilities |

Starts from $9,000 per month |

| SAP |

BW/4HANA |

Advanced analytics and tailored applications as per business need |

Available on request |

| Google |

BigQuery |

Built-in query acceleration

and serverless architecture |

On-demand pricing and flat-rate pricing |

| Snowflake |

Snowflake for Data Warehouse |

Fully separate computation and storage |

30-day free trial that values $400 |

| Cloudera |

Cloudera Data Platform |

30x faster scaling capacity |

$0.07 per CCU on an hourly basis |

| Micro Focus |

Vertica |

Market-leading analytical database and

improved query performance |

Available on request |

| Mark Logic |

MarkLogic |

Efficiently simplifies complex data challenges |

Available on request |

| MongoDB |

MongoDB |

Preconfigured security features and sophisticated access management |

Available on request |

| Talend |

Talend |

Data cleansing functions for simplified data governance |

Available on request |

| Informatica |

Informatica |

IDMC designed specifically for data management |

Available on request |

| Arm Treasure Data |

Customer Data Cloud |

Connected customer experience |

Available on Request |

How Do You Choose a Data Warehouse Software Provider?

Cloud or On-Premises Solutions

There are two types of data warehouse solutions: on-premises and cloud. As per the business requirements, you can choose either of them.

Cloud-based tools and software are more cost-efficient, as they do not require servers and hardware. By comparison, on-premises data warehouse solutions offer more security and have lesser latency issues due to controlled access.

Many businesses also opt for the hybrid solution—a combination of both cloud-based and on-premises data warehouse software and tools.

Pricing

The pricing can be complicated in the data warehousing market. Many vendors may offer the same price, but the quality of the services can vary considerably. In the end, it is all about the effectiveness of these tools and software. So when considering different vendors, it is important to assess the features, efficiency, and quality of service they offer.

As data needs grow at an enormous scale, software and tools must be able to scale with it. They must also efficiently accumulate information from diverse sources. Moreover, they should easily integrate into the existing business infrastructure.

How We Evaluated the Best Data Warehouse Software

We evaluated the best data warehouse tools on the basis of the advanced features they offer, user reviews, recognition, and performance in the global market. Original source platforms and different review websites have been considered for the evaluation.