No holiday miracles for tablet makers this year. Tablet shipments will continue their decline for 2015, according to International Data Corporation’s (IDC) latest forecast. For 2015, that tablet vendors will have shipped 211.3 million units, an 8.1 percent drop from 2014 figures, IDC announced today. Last year, tablet shipments totaled 229.6 million units. While the […]

Datamation content and product recommendations are

editorially independent. We may make money when you click on links

to our partners.

Learn More

No holiday miracles for tablet makers this year. Tablet shipments will continue their decline for 2015, according to International Data Corporation’s (IDC) latest forecast.

For 2015, that tablet vendors will have shipped 211.3 million units, an 8.1 percent drop from 2014 figures, IDC announced today. Last year, tablet shipments totaled 229.6 million units.

While the popularity of tablets is waning, one form factor increasingly is gaining market acceptance.

Seeking the versatility of both touch and keyboard input, buyers are driving demand for two-in-ones, according to IDC research director, Jean Philippe Bouchard. “We’re witnessing a real market transition as end users shift their demand towards detachables and more broadly towards a productivity-based value proposition,” he said in prepared remarks. “The proliferation of detachable offerings from hardware vendors continues to help drive this switch.”

Backed by the major OS makers and device manufacturers, two-in-ones are cementing their place in the tablet market. Tumbling prices also help.

“We’re starting to see the impact of competition within this space as the major platform vendors – Apple, Google and Microsoft – now have physical product offerings,” Bouchard observed. “With attractive price points, including the introduction of sub-$100 detachables, and platform innovation being driven by competition, IDC is confident that the detachables segment will nearly double in size in the next year, recording more than 75 percent growth compared to 2015.

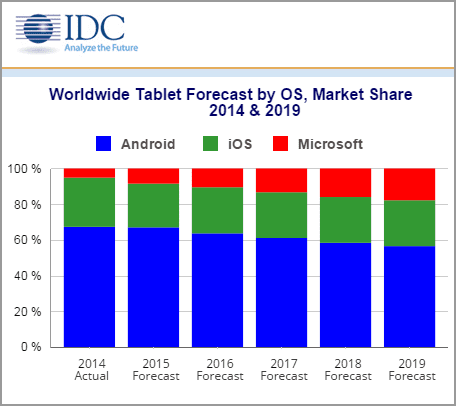

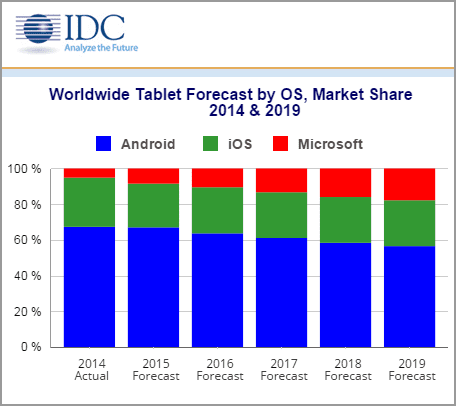

Tablets based on Microsoft’s Windows OS will make big gains over the next few years, at the expense of both Android and Apple iOS.

IDC expects the share of Windows tablets to grow to 17.8 percent in 2019, from just over 5 percent in 2014. “The transition to detachable tablets also ushers in two other key trends: the growth of Windows and a turnaround for Apple’s iPad device line,” said Jitesh Ubrani, senior research analyst for IDC Worldwide Mobile Device Trackers.

Characterizing the iPad Pro’s early reviews as “mixed,” Ubrani considers the supersized tablet “to be the only reason for Apple to gain tablet market share in the coming years as they target select enterprise and prosumer audiences.” But there are limits to how big tablet screen sizes can go, IDC’s data suggests.

Massive tablets (between 13 inches and 16 inches) will remain a niche category, growing from a scant 0.1 percent of the market in 2014 to a mere 2 percent in 2019. The sweet spot is medium-sized tablets (between 9 inches and 13 inches), with an expected 55 percent of the market in 2019. Despite an initial surge in popularity, the share of mini tablets (between 7 inches and 9 inches) will drop to 43 percent of the market in 2019 from 64.1 percent in 2014.

Meanwhile, Microsoft will make the most of its considerable clout in the market for business-friendly devices. “At the same time we expect Windows-based devices – slates and detachables combined – to more than double its market share by 2019, driven by a combination of traditional PC OEMs as well as more household smartphone vendors,” Ubrani stated.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Photo courtesy of Shutterstock.

-

Ethics and Artificial Intelligence: Driving Greater Equality

FEATURE | By James Maguire,

December 16, 2020

-

AI vs. Machine Learning vs. Deep Learning

FEATURE | By Cynthia Harvey,

December 11, 2020

-

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

-

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

-

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

-

Top 10 AIOps Companies

FEATURE | By Samuel Greengard,

November 05, 2020

-

What is Text Analysis?

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

-

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

-

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

-

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

-

Top 10 Chatbot Platforms

FEATURE | By Cynthia Harvey,

October 07, 2020

-

Finding a Career Path in AI

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

-

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

-

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

-

Top 10 Machine Learning Companies 2021

FEATURE | By Cynthia Harvey,

September 22, 2020

-

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

-

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

-

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

-

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

-

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

SEE ALL

ARTICLES