Amazon Web Services (AWS) is still the cloud provider to beat, but other IT titans are growing faster, according to a new analysis from the Synergy Research Group. With nearly a third of the cloud infrastructure services market, AWS closed out the fourth quarter (Q4) of 2015 in first place. “Amazon/AWS continues to be in […]

Datamation content and product recommendations are

editorially independent. We may make money when you click on links

to our partners.

Learn More

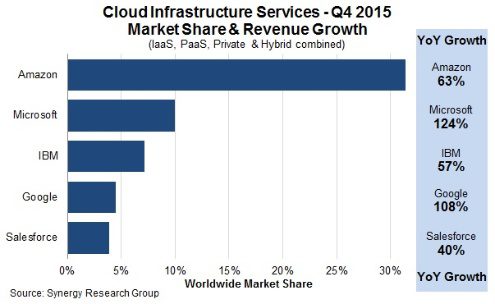

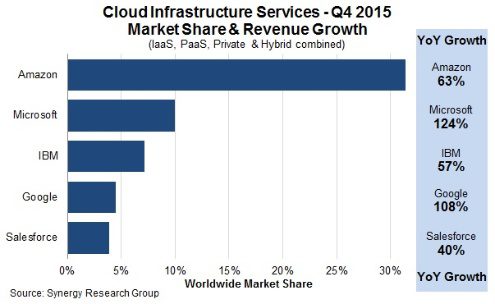

Amazon Web Services (AWS) is still the cloud provider to beat, but other IT titans are growing faster, according to a new analysis from the Synergy Research Group.

With nearly a third of the cloud infrastructure services market, AWS closed out the fourth quarter (Q4) of 2015 in first place. “Amazon/AWS continues to be in a league of its own with a worldwide market share of over 31 percent” for the year, said John Dinsdale, chief Analyst and research Director at Synergy, in an email to Datamation.

Cloud Storage and Backup Benefits

Protecting your company’s data is critical. Cloud storage with automated backup is scalable, flexible and provides peace of mind. Cobalt Iron’s enterprise-grade backup and recovery solution is known for its hands-free automation and reliability, at a lower cost. Cloud backup that just works.

SCHEDULE FREE CONSULT/DEMO

Amazon’s share of the market grew 63 percent last quarter, year-over-year, but Microsoft and its sprawling cloud portfolio are growing faster.

Microsoft’s cloud grew a whopping 124 percent last quarter, compared to the same year-ago period. All told, the Redmond, Wash. software company claimed 9 percent of the cloud infrastructure services market in 2015 for second place.

Meanwhile, a Mountain View, Calif. rival also made some major progress. Google notched a 108 percent year-over-year growth rate in Q4 2015. For the full year, Google claimed 4 percent of the market for fourth place.

Despite these gains, it’s unlikely either will topple AWS any time soon. “Microsoft and Google both have tremendous growth rates but are so far behind AWS that they are not really impacting on its market share and leadership position,” said Dinsdale.

Enterprise-friendly Big Blue still ranks high among cloud providers with a still-respectable growth rate of 57 percent and a 7-percent share of the market. “IBM remains one of the big four thanks in large part to its leadership in the private and hybrid services segment,” Dinsdale observed. IBM finished the year in third place, above Google.

Rounding out the top five is Salesforce, tying Google with 4 percent of the market but growing slower at 40 percent.

Collectively, Synergy estimates that the cloud infrastructure services market, which includes IaaS, PaaS, private and hybrid cloud, is nearing $7 billion in quarterly revenues and $23 billion in trailing 12-month sales. Compared to 2014, revenues climbed 52 percent last year. Last month, Synergy said that the cloud computing market as a whole – including cloud infrastructure services, SaaS and unified-communications-as-a-service (UCaaS), hardware and software — passed the $110 billion milestone in annual revenues in Q3 2015.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.

Photo courtesy of Shutterstock.

-

Huawei’s AI Update: Things Are Moving Faster Than We Think

FEATURE | By Rob Enderle,

December 04, 2020

-

Keeping Machine Learning Algorithms Honest in the ‘Ethics-First’ Era

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 18, 2020

-

Key Trends in Chatbots and RPA

FEATURE | By Guest Author,

November 10, 2020

-

Top 10 AIOps Companies

FEATURE | By Samuel Greengard,

November 05, 2020

-

What is Text Analysis?

ARTIFICIAL INTELLIGENCE | By Guest Author,

November 02, 2020

-

How Intel’s Work With Autonomous Cars Could Redefine General Purpose AI

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 29, 2020

-

Dell Technologies World: Weaving Together Human And Machine Interaction For AI And Robotics

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

October 23, 2020

-

The Super Moderator, or How IBM Project Debater Could Save Social Media

FEATURE | By Rob Enderle,

October 16, 2020

-

Top 10 Chatbot Platforms

FEATURE | By Cynthia Harvey,

October 07, 2020

-

Finding a Career Path in AI

ARTIFICIAL INTELLIGENCE | By Guest Author,

October 05, 2020

-

CIOs Discuss the Promise of AI and Data Science

FEATURE | By Guest Author,

September 25, 2020

-

Microsoft Is Building An AI Product That Could Predict The Future

FEATURE | By Rob Enderle,

September 25, 2020

-

Top 10 Machine Learning Companies 2020

FEATURE | By Cynthia Harvey,

September 22, 2020

-

NVIDIA and ARM: Massively Changing The AI Landscape

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

September 18, 2020

-

Continuous Intelligence: Expert Discussion [Video and Podcast]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 14, 2020

-

Artificial Intelligence: Governance and Ethics [Video]

ARTIFICIAL INTELLIGENCE | By James Maguire,

September 13, 2020

-

IBM Watson At The US Open: Showcasing The Power Of A Mature Enterprise-Class AI

FEATURE | By Rob Enderle,

September 11, 2020

-

Artificial Intelligence: Perception vs. Reality

FEATURE | By James Maguire,

September 09, 2020

-

Anticipating The Coming Wave Of AI Enhanced PCs

FEATURE | By Rob Enderle,

September 05, 2020

-

The Critical Nature Of IBM’s NLP (Natural Language Processing) Effort

ARTIFICIAL INTELLIGENCE | By Rob Enderle,

August 14, 2020

SEE ALL

CLOUD ARTICLES