Public cloud giants slowed their spending in the first quarter (Q1) of 2016, but that didn’t stop the cloud hardware market from making some gains.

Worldwide, cloud IT infrastructure vendors sold $6.6 billion worth of servers, storage and Ethernet switch networking equipment, a 3.9 percent year-over-year increase, said research firm International Data Corporation (IDC). Public clouds were responsible for $3.9 billion of that total.

Cloud Storage and Backup Benefits

Protecting your company’s data is critical. Cloud storage with automated backup is scalable, flexible and provides peace of mind. Cobalt Iron’s enterprise-grade backup and recovery solution is known for its hands-free automation and reliability, at a lower cost. Cloud backup that just works.

“A slowdown in hyperscale public cloud infrastructure deployment demand negatively impacted growth in both public cloud and cloud IT overall,” observed IDC research director Kuba Stolarski, in a statement. “Private cloud deployment growth also slowed, as 2016 began with difficult comparisons to 1Q15, when server and storage refresh drove a high level of spend and high growth. As the system refresh has mostly ended, this will continue to push private cloud and, more generally, enterprise IT growth downwards in the near term.

Server and Ethernet switch sales to public clouds jumped 8.7 percent and 69.4 percent respectively, while storage dropped 29.6 percent from a year ago. On the private cloud side of the market, server revenues fell 1.1 percent but both storage and switches experienced gains of 11.5 percent and 53.7 percent, respectively.

All told, the cloud IT infrastructure market accounted for nearly a third (32.3 percent) of all IT revenues during Q1, an increase of over 2 percent compared to last year.

Regionally, sales grew briskly in the Middle East and Africa (25.9 percent), Western Europe (20.6), Asia-Pacific (18.5) and Japan (17.7 percent). Latin America experienced the biggest decline (21.2 percent) while revenues in the U.S. slipped 4.1 percent. Sales in Central and Eastern Europe were essentially flat (-0.1 percent). Meanwhile, Canadian sales jumped 9.5 percent.

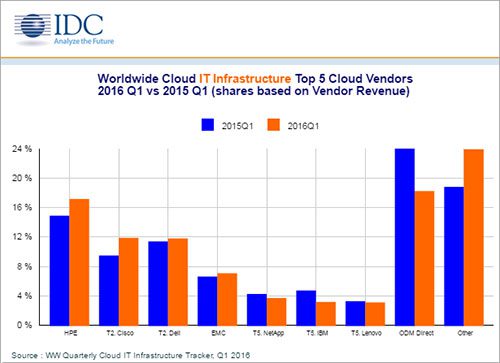

HP Enterprise (HPE) won first place with revenues of approximately $1.14 billion and a 17.2 percent share of the market. Cisco and Dell tied for second place with over $780 million and nearly 12 percent of the market apiece. Rounding out the top five are EMC, with NetApp, IBM and Lenovo tied for fifth place.

Over time, IDC expects hyperscale cloud operators like Amazon, Microsoft and IBM to help reinvigorate the market as they work to expand their global data center footprints. “Hyperscale demand should return to higher deployment levels later this year, bolstered by service providers who have announced new datacenter builds expected to go online this year,” said Stolarski.

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.